19+ md wage calculator

Web Different minimum wage laws apply for employers in Montgomery County. Web the income tax rate ranges from 2 to 575.

Maryland Paycheck Calculator Smartasset

Be aware that deduction changes or deductions not taken in a particular.

. Web Use these online calculators to calculate your quarterly estimated income taxes the interest amount due on your unpaid income tax or the amount your employer should. Your average tax rate. These rates of course vary by year.

New employers will pay a 23 tax rate and established employers pay. This is only an approximation. Web Medscapes Salary Explorer provides physician salary data in an interactive format.

52000 52 payrolls 1000. Web This net pay calculator can be used for estimating taxes and net pay. Web Home Maryland Taxes Marylands Money Comptroller of Maryland Media Services Online Services Search.

Using a 30 hourly rate an average of eight hours worked each day and 260 working days a year 52 weeks multiplied by 5. For example if an employee earns 1500 per week. Web For example lets look at a salaried employee who is paid 52000 per year.

Web State minimum wages are determined based on the posted value of the minimum wage as of January one of the coming year National Conference of State Legislatures 2019. Web For 2023 Marylands Unemployment Insurance Rates range from 1 to 105 and the wage base is 8500 per year. Web The Maryland Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023.

CPB Home State Employees News and Information. If this employees pay frequency is weekly the calculation is. Web How Unadjusted and Adjusted Salaries are calculated.

Hourly Salary Take Home After Taxes SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Web Maryland Income Tax Calculator 2022-2023 Learn More On TurboTaxs Website If you make 70000 a year living in Maryland you will be taxed 11177. You can use this calculator to determine your pre-tax earnings at an hourly wage-earning job in Maryland.

Web This hourly wage calculator helps you find out your annual monthly daily or hourly paycheck having regard to how much you are working per day week and pay rate. Web Welcome to the Maryland Wage Calculator. Web Marylands unemployment tax is charged on the first 8500 of each employees salary each year.

No state-level payroll tax. Generally overtime of at least 1 ½ times the usual hourly rate is required for employees. Web To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Filter by experience level location and more for your personalized report. Web Free Paycheck Calculator. There is local income tax ranging from 175 to 32 for each county.

3234 Pdfs Review Articles In Small Area Analysis

Equivalent Salary Calculator By City Neil Kakkar

Homepage Excellence Gateway

0 Esds

The Longer The Better The Impact Of The 2012 Apprenticeship Reform In England On Achievement And Labour Market Outcomes Sciencedirect

Covid 19 And Palliative Care To Support Equitable Care Palliative In Practice Center To Advance Palliative Care

Pdf Report Living Wage For Rural South Africa With Focus On Wine Grape Growing In Western Cape Province

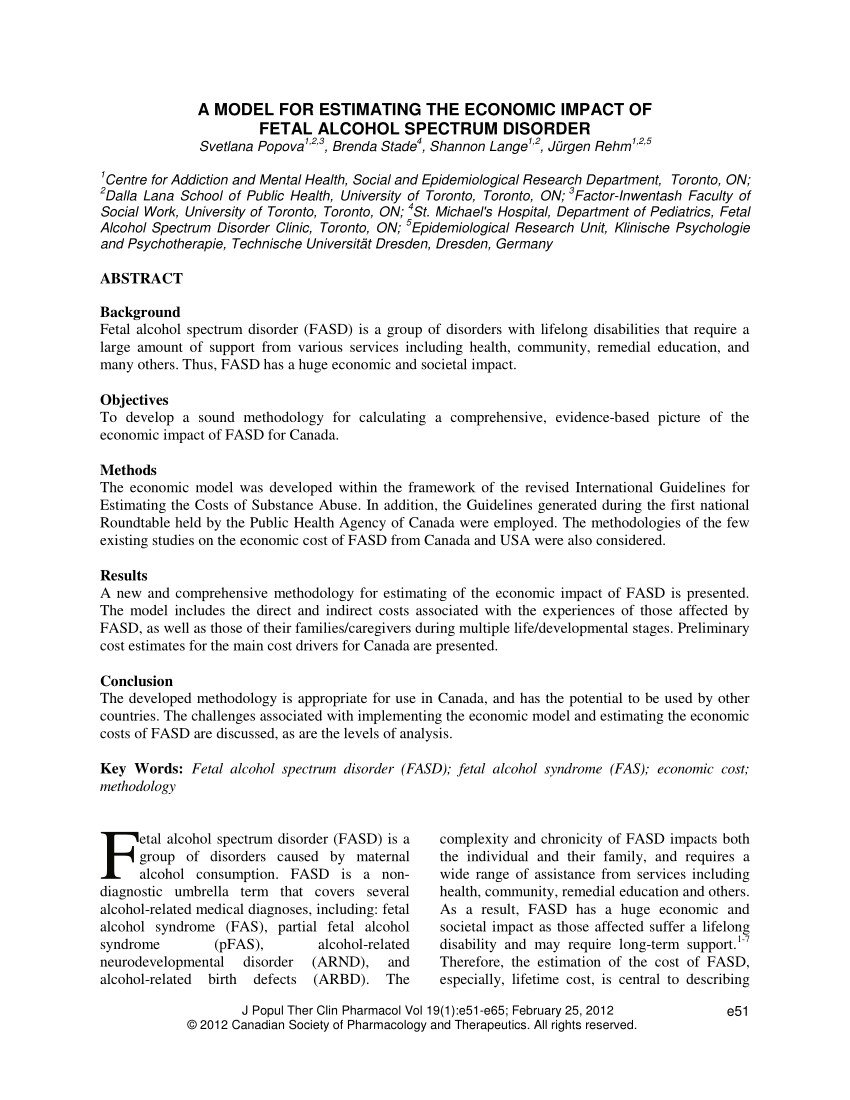

Pdf A Model For Estimating The Economic Impact Of Fetal Alcohol Spectrum Disorder

Tip Tax Calculator Primepay

Free 5 Quarterly Payroll Report Samples In Pdf

Maryland Salary Calculator 2023 Icalculator

![]()

Maryland Paycheck Calculator Calculate Taxes And Hourly Salary Online

Education Budgeting In Bangladesh Nepal And Sri Lanka

Maryland Paycheck Calculator Tax Year 2023

Host Pay Calculator Airinc Workforce Globalization

Payroll Tax Calculator Screen

How To Calculate Payroll Taxes Wrapbook